SBLC monetization is the entire process of liquidating/changing an SBLC into liquid funds, typically by way of a economic institution or monetizer.

Like several business mortgage, you will need to reveal your creditworthiness into the lender. Nevertheless, the approval method for an SBLC is much faster, with letters normally staying issued in a 7 days In spite of everything important paperwork is submitted.

Monetization Agreement: As soon as the SBLC is validated, the SBLC holder plus the monetization provider enter into an settlement, which outlines the conditions, situations, and fees related to the monetization approach.

Non-recourse financial loans can also be backed by devices that obtain governing administration bonds, supplying organizations with the pliability they need to secure funding devoid of sacrificing useful belongings.

In conclusion, SBLC monetization is a posh course of action that needs mindful thing to consider by all events concerned. When it can offer instant cash or credit score for that beneficiary, What's more, it carries challenges and implications that must be comprehended and managed. Homework is important while in the SBLC monetization method to make certain the SBLC is valid and enforceable, and which the monetizer is dependable and it has the economical capability to honor their commitments.

SBLC monetization has quite a few implications for that functions included. For your beneficiary, SBLC monetization offers quick hard cash or credit rating, which may be accustomed to finance their functions or pay off existing financial debt. For that issuer on the SBLC, SBLC monetization is often considered for a breach of agreement, since the SBLC wasn't intended to be monetized.

SBLC monetization gives a means for that beneficiary to get quick cash or credit rating in exchange for an SBLC. There are various ways of SBLC monetization, such as discounting, assignment, and leasing. The functions involved in SBLC monetization should work out homework to ensure that the SBLC is legitimate and enforceable, and that the monetizer is respected and it has the economic sblc provider capability to honor their commitments.

The following dialogue will offer a comprehensive idea of the linked Advantages and inherent challenges, while also furnishing pragmatic insights into chance mitigation methods.

The SBLC may very well be assigned or transferred to the monetization associate, as well as the beneficiary’s lender could concern a payment enterprise for the monetization lover.

It’s essential to Notice that SBLC monetization also includes particular difficulties and concerns:

Liquidity: Monetization gives fast entry to money, which can be important for seizing time-sensitive possibilities or addressing economic desires.

Being familiar with the whole process of SBLC monetization necessitates a radical assessment of your documentation required to facilitate this monetary transaction. Guaranteeing document authenticity and comprehending the legal implications are crucial.

Increased Money Adaptability: SBLC monetization can offer you much more adaptability as compared to classic loans and credit rating lines, since it’s structured within the value of the SBLC.

Monetizing a Standby Letter of Credit history (SBLC) is a successful economical method for corporations seeking to unlock liquidity with out promoting assets. As financial regulations tighten in 2025, understanding the SBLC monetization process is crucial for securing authentic funding.

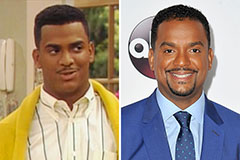

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Jenna Von Oy Then & Now!

Jenna Von Oy Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now!